K92 Announces Further High Grade Kora Exploration Drill Results From Kora Northern Extension

- Drill Hole KMDD0034 records 4.1 m at 9.19 g/t Au, 4.2 g/t Ag and 0.02% Cu (9.27 g/t AuEq) plus 3.6m at 36.06 g/t Au, 354 g/t Ag and 0.66% Cu (41.56 g/t AuEq)

- Second Diamond Drill Cuddy now established and third diamond drill rig has commenced drilling from this cuddy

K92 Mining Inc. (“K92”) (TSXV:KNT) (OTCQB:KNTNF) is pleased to announce results from the continuing grade control and exploration drilling of the Kora North Extension. Results reported include holes KMDD0026, 28 30, 32 and 34 from Diamond Drill Cuddy One (DDC1), as well as holes to the north of this area (KMDD0025, 27, 29, 31 and 33) evaluating further extensions of Kora.

In addition, the Company has now completed the development of the second drill cuddy (DDC2) 125 metres to the south of DDC1 and has commenced drilling from this cuddy with a third drill rig.

John Lewins, K92 Chief Executive Officer and Director, states, “The ongoing results from the grade control drilling from DDC1 have confirmed our interpretation of this Northern Extension of Kora in this area. In addition, drilling further to the north of the DDC1 zone has indicated that Kora may not have pinched out as previously interpreted, but may persist parallel, and to the west of Irumafimpa. Further drilling is planned in this area to confirm this.”

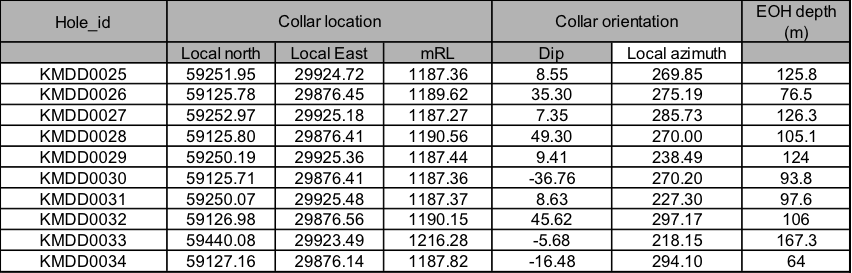

Table 1 and 2 below provide a summary of the results from the latest diamond grade control drill hole drilled into the Kora Vein. Table 1 provides a summary of the significant intercepts from the hole, while Table 2 provides details of collar location and hole orientation.

TABLE 1.0 KAINANTU GOLD MINE – SIGNIFICANT INTERCEPTS FROM KORA UNDERGROUND DIAMOND DRILLING

| Hole_id | From (m) | To (m) | Interval (m) | True width (m) | Gold g/t | Silver g/t | Copper % | Gold equivalent |

|---|---|---|---|---|---|---|---|---|

| KMDD0025 | 46.6 | 46.9 | 0.3 | 0.29 | 6.86 | 5 | 0.07 | 7.03 |

| KMDD0025 | 52.2 | 55.4 | 3.2 | 3.06 | 1.68 | 2.30 | 0.02 | 1.74 |

| Including | 52.2 | 52.75 | 0.5 | 0.53 | 2.36 | 2 | 0.02 | 2.41 |

| Including | 52.75 | 53.1 | 0.4 | 0.34 | 1.75 | 1 | 0.00 | 1.77 |

| Including | 53.1 | 53.6 | 0.5 | 0.48 | 0.35 | 1 | 0.00 | 0.37 |

| Including | 53.6 | 55.4 | 1.8 | 1.72 | 1.83 | 3 | 0.03 | 1.91 |

| KMDD0026 | 15.44 | 17.7 | 2.3 | 1.55 | 1.32 | 3 | 0.21 | 1.68 |

| Including | 15.44 | 15.64 | 0.2 | 0.16 | 6.78 | 15 | 1.83 | 9.77 |

| KMDD0026 | 52.8 | 54.63 | 1.8 | 1.49 | 3.94 | 4 | 0.11 | 4.16 |

| including | 52.8 | 53.5 | 0.7 | 0.57 | 4.45 | 3 | 0.07 | 4.60 |

| including | 53.5 | 54.63 | 1.1 | 0.92 | 3.62 | 4 | 0.14 | 3.88 |

| KMDD0027 | 45.47 | 45.88 | 0.4 | 0.40 | 15.43 | 3 | 0.08 | 15.59 |

| KMDD0027 | 53.05 | 57.03 | 4.0 | 3.84 | 4.05 | 2 | 0.05 | 4.15 |

| Including | 53.05 | 54.2 | 1.2 | 1.11 | 7.53 | 5 | 0.04 | 7.66 |

| including | 54.2 | 55.3 | 1.1 | 1.06 | 1.29 | 0.05 | 0.01 | 1.30 |

| including | 56.4 | 57.03 | 0.6 | 0.61 | 4.04 | 2 | 0.09 | 4.20 |

| KMDD0027 | 86.51 | 86.8 | 0.3 | 0.28 | 5.53 | 1 | 0.02 | 5.56 |

| KMDD0028 | 19.7 | 26.5 | 6.8 | 3.66 | 4.20 | 2 | 0.02 | 4.25 |

| Including | 19.7 | 20.8 | 1.1 | 0.70 | 18.2 | 4 | 0.07 | 18.36 |

| Including | 22 | 22.9 | 0.9 | 0.57 | 2.11 | 1 | 0.02 | 2.16 |

| including | 22.9 | 23.6 | 0.7 | 0.45 | 1.06 | 1 | 0.00 | 1.08 |

| including | 25.1 | 26.5 | 1.4 | 0.34 | 2.33 | 1 | 0.01 | 2.35 |

| KMDD0028 | 65.6 | 66.3 | 0.7 | 0.45 | 8.17 | 18 | 0.29 | 8.84 |

| KMDD0029 | 65.3 | 65.8 | 0.5 | 0.46 | 5.18 | 2 | 0.02 | 5.23 |

| KMDD0029 | 109.15 | 110.25 | 1.1 | 0.94 | 2.22 | 17 | 0.22 | 2.77 |

| KMDD0030 | 14 | 17.4 | 3.4 | 1.88 | 3.18 | 6 | 0.34 | 3.78 |

| including | 14 | 15 | 1.0 | 0.55 | 2.82 | 1.6 | 0.01 | 2.86 |

| including | 15 | 16.3 | 1.3 | 0.72 | 1.63 | 2.5 | 0.02 | 1.69 |

| including | 16.3 | 17.4 | 1.1 | 0.61 | 5.33 | 14.7 | 1.03 | 7.10 |

| KMDD0030 | 73 | 74.2 | 1.2 | 0.39 | 3.82 | 5 | 0.31 | 4.36 |

| KMDD0030 | 79.2 | 79.7 | 0.5 | 0.28 | 3.45 | 22 | 2.56 | 7.63 |

| including | 79.2 | 79.5 | 0.3 | 0.17 | 4.93 | 34.3 | 4.08 | 11.61 |

| including | 79.5 | 79.7 | 0.2 | 0.11 | 1.22 | 2.5 | 0.27 | 1.67 |

| KMDD0031 | 65.5 | 65.8 | 0.3 | 0.23 | 1.97 | 13 | 2.56 | 6.06 |

| KMDD0031 | 71.4 | 77 | 5.6 | 4.33 | 6.17 | 3 | 0.10 | 6.36 |

| including | 72.2 | 73.2 | 1.0 | 0.77 | 4.23 | 1.5 | 0.08 | 4.37 |

| including | 75.1 | 76 | 0.9 | 0.70 | 5.59 | 4.2 | 0.02 | 5.68 |

| including | 76 | 77 | 1.0 | 0.77 | 20.11 | 4.6 | 0.05 | 20.25 |

| KMDD0032 | 66.4 | 68.6 | 2.2 | 1.43 | 8.905 | 26.95 | 1.09 | 10.92 |

| including | 66.4 | 67.5 | 1.1 | 0.71 | 10.24 | 1.8 | 0.06 | 10.36 |

| including | 67.5 | 68.6 | 1.1 | 0.71 | 7.57 | 52.1 | 2.12 | 11.48 |

| KMDD0033 | 39 | 39.5 | 0.5 | 0.30 | 0.86 | 18 | 3.20 | 5.98 |

| KMDD0033 | 51 | 52 | 1.0 | 0.60 | 3.03 | 0 | 0.02 | 3.07 |

| KMDD0033 | 65.45 | 68.1 | 2.6 | 1.58 | 1.07 | 0 | 0.13 | 1.27 |

| Including | 65.45 | 65.6 | 0.1 | 0.09 | 1.83 | 1.4 | 0.04 | 1.91 |

| Including | 66.3 | 67.4 | 1.1 | 0.66 | 1.57 | 0.4 | 0.23 | 1.93 |

| KMDD0033 | 71 | 72.3 | 1.3 | 0.78 | 3.25 | 3 | 0.27 | 3.70 |

| KMDD0033 | 147 | 148.8 | 1.8 | 1.07 | 2.35 | 5 | 0.21 | 2.73 |

| KMDD0034 | 14 | 18.1 | 4.1 | 3.15 | 9.19 | 4.21 | 0.02 | 9.27 |

| including | 14 | 14.6 | 0.6 | 0.46 | 1.90 | 2 | 0.02 | 1.94 |

| including | 17.7 | 18.1 | 0.4 | 0.31 | 90.99 | 41 | 0.02 | 91.54 |

| KMDD0034 | 55.6 | 59.2 | 3.6 | 2.77 | 36.06 | 354 | 0.66 | 41.56 |

| including | 55.6 | 56.7 | 1.1 | 0.85 | 3.71 | 5 | 0.78 | 4.96 |

| including | 56.7 | 57.75 | 1.1 | 0.81 | 1.63 | 9 | 0.95 | 3.20 |

| including | 57.75 | 58.7 | 1.0 | 0.73 | 129.91 | 1327 | 0.53 | 147.56 |

Notes

Gold Equivalent uses Copper price – US$2.90/lb; Silver price US$16.5/oz and Gold price of US$1300/oz

TABLE 2.0 KAINANTU GOLD MINE – COLLAR LOCATIONS FOR KORA UNDERGROUND DIAMOND DRILLING

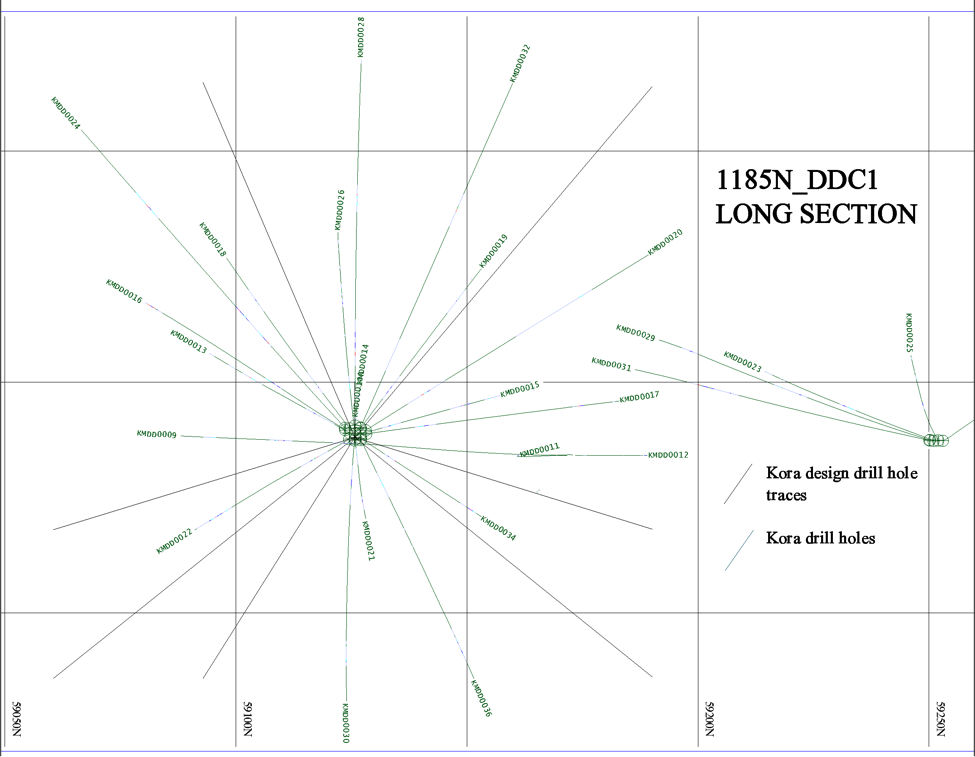

FIGURE 1 KORA UNDERGROUND DIAMOND DRILL PROGRAM FROM DRILL CUDDY DDC1

The current Kora/Eutompi inferred resource, as defined by previous drilling to date, is 4.36 million tonnes at a grade of 7.3 g/t Au, 35 g/t Ag and 2.23 per cent Cu, or 11.2 g/t gold equivalent (see attached table) and is open for expansion at depth and in both directions along strike.

K92 has filed and made available for download on the company’s SEDAR profile a technical report titled “Independent Technical Report, Mineral Resource Update and Preliminary Economic Assessment of Irumafimpa and Kora Gold Deposits, Kainantu Project, Papua New Guinea,” with an effective date of March 2, 2017, that provides additional information on the geology of the deposits, drilling and sampling procedures, lab analysis, and quality assurance/quality control for the project, and additional details on the resource estimates.

The PEA estimates for Kora, based on the current resource estimates (4.36 million tonnes of 7.3 g/t Au, 35 g/t Ag and 2.23 per cent Cu):

- Over a nine-year operating life, the plant would treat 3.2 million tonnes averaging 7.1 g/t Au, 25 g/t Ag and 1.7 per cent Cu (9.3 g/t AuEq (1));

- This would generate an estimated positive cash flow of $537-million (U.S.) using current metal prices if 15-metre levels are used in mining; if 25-metre levels are used, then net cash flows are estimated as $558-million (U.S.); this cash flow includes conceptual allowances for capital;

- Production of an estimated average of 108,000 AuEq (1) ounces per annum over an eight-year period from year 2 through to year 9;

- An estimated pretax net present value (NPV) of $415-million (U.S.) for 25-metre levels, or $397-million (U.S.) for 15-metre levels, using current metal prices, exchange rates and a 5-per-cent discount;

- An estimated after-tax NPV of $329-million (U.S.) for 25-metre levels, or $316-million (U.S.) for 15-metre levels, using current metal prices, exchange rates and a 5-per-cent discount;

- Initial capital cost is estimated to be $13.8-million (U.S.), including the $3.3-million (U.S.) for the plant upgrade identified in the Mincore scoping study, but excluding the proposed Kora exploration inclines and diamond drilling; sustaining capital cost is estimated to a further $64-million (U.S.) spent over the life of the Kora mining for 25-metre levels, or $83-million (U.S.) for 15-metre levels;

- Operating cost per tonne is estimated to be $125 (U.S.) per tonne for 25-metre levels, or $126 (U.S.) per tonne for 15-metre mining levels;

- Excluding initial capital expenditure of $14-million (U.S.), cash cost is estimated to be $547 (U.S.) per ounce AuEq (inclusive of a 2.5-per-cent net smelter return (NSR) royalty) and all-in sustaining cost (AISC) of $619 (U.S.) per ounce AuEq for 25-metre mining levels, or $549 (U.S.) per ounce (inclusive of a 2.5-per-cent NSR royalty) and AISC of $644 (U.S.) per ounce AuEq for 15-metre mining levels.

Metal prices used were $1,300 per ounce for gold, $18 (U.S.) per ounce for silver and $4,800 per tonne for copper.

(1) Gold equivalent calculated on above metal prices.

Kora remains open for expansion in every direction and strongly mineralized at the extent of all drilling.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. The technical report contains a full description of all underlying assumptions relating to the PEA. Mineral resources that are not mineral reserves and do not have demonstrated economic viability.

TABLE 3.0 IRUMAFIMPA AND KORA/EUTOMPI RESOURCES

| Resource by Deposit and Category | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Deposit | Resource

Category |

Tonnes | Gold | Silver | Copper | Gold Equivalent | ||||

| Mt | g/t | MOz | g/t | MOz | % | Mlb | g/t | MOz | ||

| Irumafimpa | Indicated | 0.56 | 12.8 | 0.23 | 9 | 0.16 | 0.28 | 37 | 13.4 | 0.24 |

| Inferred | 0.53 | 10.9 | 0.19 | 9 | 0.16 | 0.27 | 74 | 11.5 | 0.20 | |

| Kora/Eutompi | Inferred | 4.36 | 7.3 | 1.02 | 35 | 4.9 | 2.23 | 215 | 11.2 | 1.57 |

| Total Indicated | 0.56 | 12.8 | 0.23 | 9 | 0.16 | 0.3 | 4 | 13.4 | 0.24 | |

| Total Inferred | 4.89 | 7.7 | 1.21 | 32 | 5.06 | 2.0 | 218 | 11.2 | 1.76 | |

M in Table is millions. Reported tonnage and grade figures are rounded from raw estimates to reflect the order of accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Gold equivalents are calculated as AuEq = Au g/t + Cu%*1.52+ Ag g/t*0.0141.

K92 Vice President Chris Muller, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Muller includes significant time onsite reviewing drill core, surface exposures, underground workings and discussing work programs and results with exploration personnel.

ON BEHALF OF THE COMPANY,

John Lewins, Chief Executive Officer and Director

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information, including statements regarding the realization of the preliminary economic analysis for the Project, expectations of future cash flows, the proposed plant expansion, potential expansion of resources and the generation of further drilling results which may or may not occur. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the market price of the Company’s securities, metal prices, exchange rates, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes, failure of plant, equipment or processes to operate as anticipated, accidents, labour disputes, claims and limitations on insurance coverage and other risks of the mining industry, changes in national and local government regulation of mining operations, and regulations and other matters.. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.