K92 Announces Increased Resource for Kora North

HIGHLIGHTS INCLUDE:

- The updated Mineral Resource estimate for the Kora North deposit comprises a Measured Resource of 154,000 tonnes @ 18.7 g/t Au, 8.9 g/t Ag and 0.5% Cu; an Indicated Resource of 690,000 tonnes @ 11.6 g/t Au, 14.1 g/t Ag and 0.8% Cu and an Inferred Resources of 1.92 million tonnes @ 11.4 g/t Au, 13.1 g/t Ag and 0.7% Cu.

- The total Measured, Indicated and Inferred Resource covers an area of approximately 400 to 500 metres on strike by 200 to 350 metres vertically, representing approximately 15% of the target area to be drilled over the next 12 months.

VANCOUVER, British Columbia, Nov. 13, 2018 (GLOBE NEWSWIRE) -- K92 Mining Inc. (TSXV: KNT; OTCQX: KNTNF) (“K92” or “the Company”) is pleased to announce that an updated resource estimate has been completed at its Kora North deposit, based on results from underground grade control, exploration diamond drilling and face sampling. The updated resource estimate comprises a Measured Resource of 154,000 tonnes @ 18.7 g/t Au, 8.9 g/t Ag and 0.5% Cu; an Indicated Resource of 690,000 tonnes @ 11.6 g/t Au, 14.1 g/t Ag and 0.8% Cu and an Inferred Resource of 1.92 million tonnes @ 10.7 g/t Au, 13.3 g/t Ag and 0.7% Cu. This represents an increase of over 20% in the contained gold equivalent ozs for the Measured and Indicated Resource and almost 30% for the Inferred Resource. See Table 1 below.

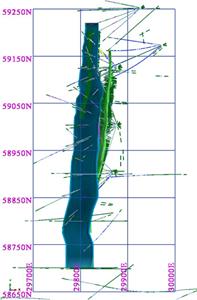

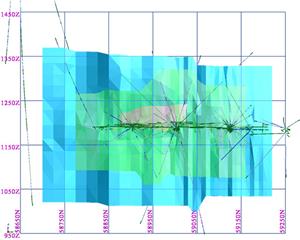

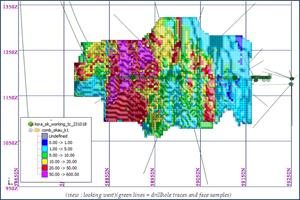

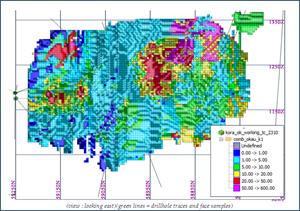

This updated resource estimate is based on results from 80 diamond drill holes drilled from Diamond Drill Cuddies 1, 2, 3 and 4 (DDC1, DDC2, DDC3 & DDC4) and over 1,300 face samples taken from horizontal development and from cut and fill faces along the K1 and K2 lodes. The resource estimate covers an area of approximately 400 to 500 metres along strike by 200 to 350 metres vertically (see K1 and K2 long sections below), representing approximately 15% of the target area of 1,000 metres along strike by up to 1,000 metres vertically which the Company plans to drill from underground over the coming 12 months.

The updated resource estimate has been defined after just twelve months of underground exploration drilling and represents, at the design production levels of 50 - 70,000 ounces per annum; almost seventeen years of production.

Table 1 - Kora North Mineral Resource

| Global Mineral Resources Kora North Gold-Copper Mine October 2018 | |||||||||

| Category | Tonnes | Gold | Silver | Copper | AuEq | ||||

| Mt | g/t | Mozs | g/t | Mozs | % | Mlbs | g/t | Mozs | |

| Measured | 0.15 | 18.7 | 0.09 | 8.9 | 0.04 | 0.5 | 1.6 | 19.6 | 0.09 |

| Indicated | 0.69 | 11.6 | 0.26 | 14.1 | 0.31 | 0.8 | 11.8 | 12.9 | 0.29 |

| Total M & I | 0.85 | 12.9 | 0.35 | 13.1 | 0.36 | 0.7 | 13.3 | 14.1 | 0.39 |

| Inferred Total | 1.92 | 10.7 | 0.66 | 13.3 | 0.82 | 0.7 | 29.5 | 11.9 | 0.74 |

Mineral Resources estimated prepared and verified by Simon Tear (PGEO), consultant to the Company and a director of independent consultancy H & S Consultants Pty. Ltd., Sydney, Australia (October 2018)

Key Assumptions and Parameters

Mineralization comprises two parallel, steeply west dipping, N-S striking quartz-sulphide vein systems, K1 & K2, within an encompassing dilatant structural zone hosted by phyllite. An additional structure, the Kora Link, has also been defined and provides a possible link between the two main vein systems.

Underground drilling consists of diamond core for a range of core sizes depending on length of hole and expected ground conditions. Sampling is sawn half core under geological control and generally ranges between 0.5m and 1m. Underground face sampling is completed for every fired round and is to industry standard.

QAQC data indicated no significant issues with the accuracy of the on-site analysis.

Core recovery of the mineral zone was initially 90%, this has improved to >95%. There is no relationship between core recovery and gold grade.

Geological logging is consistent and is based on a full set of logging codes covering lithology, alteration and mineralization.

The geological interpretation of the vein systems is represented as 3D wireframe solids snapped to a combination of diamond drillhole data and underground face sampling. Definition of the wireframes is based on identified gold mineralization in drillcore nominally at a 0.2g/t Au cut off in conjunction with geological control/sense and current mining widths.

Gold Equivalent (Au Eq) g/t was calculated using the formula Au g/t +(Cu% x 1.53) + Ag g/t x 0.0127. (No account of metal recoveries through the plant have been used in calculating the metal equivalent grade. However, production is currently achieving 93% metal recovery for both gold and copper and gold is currently providing 95% and copper 5% of the total revenue of the mine).

Gold price US$1,300/oz; Silver US$16.5/oz; Copper US$2.90/lb.

The wireframes were used to extract a total of 2,159 1-metre composites from the drillhole & sampling database for gold, copper and silver. No gold top cuts were applied to composites for the two main vein systems; the Kora Link had a top cut of 200ppm Au. Silver top cuts of 50 and 200ppm were applied to the K1 and K2 composite data. No top cut was applied to the copper composites. Coefficients of variation for the gold composite data were relatively low for this mineral type, around the 2 to 2.5 mark. Variography indicated modest strike continuity with a tendency for greater grade continuity in the dip direction, downhole grade continuity was poor as would be expected for this type of mineralization.

Grade interpolation of the composite data was completed using Ordinary Kriging with a block size of 1m by 5m by 5m to reflect the close spaced drilling for K1 and the face sampling. A larger block size check model indicated no evidence of over-smoothing of gold grade with the smaller block size.

Default average density values have been applied to the different lodes. The defaults are based on limited core measurements using the Archimedes Method (weight in air/weight in water).

An initial 3 Pass search strategy was applied in the grade interpolation with two additional passes. Search ellipse parameters are listed below. Search ellipse orientations generally reflected the subtle changes in dip and strike of the vein systems. Two search domains were used for K1, four search domains were used for K2 and one for the Kora Link.

| Pass No | X radius (m) | Y radius (m) | Z radius (m) | Min Data | Min Octants | Max Data |

| 1 | 2 | 25 | 25 | 12 | 4 | 32 |

| 2 | 4 | 50 | 50 | 12 | 4 | 32 |

| 3 | 4 | 75 | 75 | 12 | 4 | 32 |

| 4 | 5.25 | 100 | 100 | 12 | 4 | 32 |

| 5 | 5.25 | 100 | 100 | 6 | 2 | 32 |

Allocation of the classification of the Mineral Resources is derived from the search pass numbers which essentially is a function of the drillhole and face sample data point distribution. Additional considerations were included in the assessment of the classification; in particular, the geological understanding and complexity of the deposit, sample recovery, quality of the QAQC sampling and outcomes, density data and reconciliation with production.

| Pass Category | Resource Classification |

| 1 | Measured |

| 2 | Indicated |

| 3 | Inferred |

| 4 | Inferred |

| 5 | Inferred |

All material mined within the mineral wireframes up to the effective date (as of the end of September 2018) has been removed from the model. Gold reconciliation of the resource model with production up to the effective date has been good with the mill production in terms of recovered ounces being less than 10% above that estimated by the model.

The Inferred Mineral Resources in this estimate have a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

John Lewins, K92 Chief Executive Officer and Director, states, “In just twelve months of underground drilling, K92 has gone from commencing a resource definition program to defining a Measured and Indicated Resource at Kora North of 850,000 tonnes at 14.1 g/t AuEq containing 390,000 AuEq ozs and an Inferred Resource of 1.92 million tonnes at 11.9 g/t AuEq containing 740,000 AuEq ozs. This resource covers under 15% of the total area of 1,000 metres by 1,000 metres that we plan to drill out from underground over the next twelve months. The Measured and Indicated Resources alone represents almost six years of production at current design levels of 50 - 70,000 ozs AuEq. This has been achieved while at the same time establishing a new mining operation on the Kora deposit which is on track to produce 45,000 ozs AuEq for 2018 at a cash cost of less than US$600 per oz AuEq and an AISC of less than US$800 per ounce.”

This new resource estimate is currently being used to update the existing Preliminary Economic Assessment (PEA) which K92 has filed and made available for download on the Company's SEDAR profile. It is anticipated that the new PEA will be completed in approximately one month.

The updated Mineral Resource Estimate supersedes the PEA and the PEA can no longer be considered current.

The technical report titled, "Independent Technical Report, Mineral Resource Update and Preliminary Economic Assessment of Irumafimpa and Kora Gold Deposits, Kainantu Project, Papua New Guinea," with an effective date of March 2, 2017, provides additional information on the geology of the deposits, drilling and sampling procedures, lab analysis, and quality assurance/quality control for the project, and additional details on the resource estimates.

The existing PEA estimates for Kora, based on the resource estimate filed on March 2, 2017 (4.36 million tonnes of 7.3 g/t Au, 35 g/t Ag and 2.23 percent Cu), therefore excluding Kora North:

- Over a nine-year operating life, the plant would treat 3.2 million tonnes averaging 7.1 g/t Au, 25 g/t Ag and 1.7 percent Cu (9.3 g/t AuEq(1));

- This would generate an estimated positive cash flow of US $537 million using current metal prices if 15-metre levels are used in mining; if 25-metre levels are used, then net cash flows are estimated as US $558 million; this cash flow includes conceptual allowances for capital;

- Production of an estimated average of 108,000 AuEq(1) ounces per annum over an eight-year period from year 2 through to year 9;

- An estimated pretax net present value (NPV) of US $415 million for 25-metre levels, or US $397 million for 15-metre levels, using current metal prices, exchange rates and a 5 percent discount;

- An estimated after-tax NPV of US $329 million for 25-metre levels, or US $316 million for 15-metre levels, using current metal prices, exchange rates and a 5 percent discount;

- Initial capital cost is estimated to be US $13.8 million, including the US $3.3 million for the plant upgrade identified in the Mincore scoping study, but excluding the proposed Kora exploration inclines and diamond drilling; sustaining capital cost is estimated to a further $64-million (U.S.) spent over the life of the Kora mining for 25-metre levels, or US $83 million for 15-metre levels; and

- Operating cost per tonne is estimated to be US $125 per tonne for 25-metre levels, or US $126 per tonne for 15-metre mining levels;

- Excluding initial capital expenditure of US $14 million, cash cost is estimated to be US $547 per ounce AuEq (inclusive of a 2.5 percent net smelter return (NSR) royalty) and all-in sustaining cost (AISC) of US $619 per ounce AuEq for 25-metre mining levels, or US $549 per ounce (inclusive of a 2.5 percent NSR royalty) and AISC of US $644 per ounce AuEq for 15-metre mining levels.

(1) Gold equivalent calculated on metal prices.

Metal prices used were $1,300 per ounce for gold, $18 per ounce for silver and $4,800 per tonne for copper.

Kora remains open for expansion in every direction and strongly mineralized at the extent of all drilling.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. The technical report contains a full description of all underlying assumptions relating to the PEA. Mineral resources that are not mineral reserves and do not have demonstrated economic viability. The resource estimate used within this PEA has not incorporated the updated mineral resource estimate. The results and conclusions of any updated PEA incorporating the revised mineral resource, if completed, will be materially different than those previously disclosed.

| Table 2 | IRUMAFIMPA AND KORA/EUTOMPI RESOURCES | |||||||||

| Resource by Deposit and Category | ||||||||||

| Deposit | Resource Category | Tonnes | Gold | Silver | Copper | Gold Equivalent | ||||

| Mt | g/t | Moz | g/t | Moz | % | Mlb | g/t | Moz | ||

| Irumafimpa | Indicated | 0.56 | 12.8 | 0.23 | 9 | 0.16 | 0.28 | 37 | 13.4 | 0.24 |

| Inferred | 0.53 | 10.9 | 0.19 | 9 | 0.16 | 0.27 | 74 | 11.5 | 0.20 | |

| Kora/Eutompi | Inferred | 4.36 | 7.3 | 1.02 | 35 | 4.9 | 2.23 | 215 | 11.2 | 1.57 |

| Total Indicated | 0.56 | 12.8 | 0.23 | 9 | 0.16 | 0.3 | 4 | 13.4 | 0.24 | |

| Total Inferred | 4.89 | 7.7 | 1.21 | 32 | 5.06 | 2.0 | 218 | 11.2 | 1.76 | |

M in Table is millions. Reported tonnage and grade figures are rounded from raw estimates to reflect the order of accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Gold equivalents are calculated as AuEq = Au g/t + Cu%*1.52+ Ag g/t*0.0141.

K92 Mine Geology Manager and Mine Exploration Manager, Mr. Andrew Kohler, PGeo, a Qualified Person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings and discussing work programs and results with geology and mining personnel.

ON BEHALF OF THE COMPANY,

John Lewins

Chief Executive Officer and Director

For further information, please contact the Company at +1-604-687-7130.

K92 has a standard underground face sampling procedure in place in which face geological mapping and channel samples are taken across the strike, at right angles to the drive walls at intervals of approximately of 1.5m apart coinciding with the development advance of the heading. A geologist determines the interval lengths across the face for each sample depending on the geological character of the material. Two samples are taken per interval at waist and knee height and the corresponding widths recorded. No greater than 1.5m intervals are allowed during sampling. Samples are approximately 3.5kg in size. Assay for Au, Ag and Cu are averaged using length weighting of the sample interval and then, coupled with the orientation of channel and placed in the database. Standard QAQC procedures are used for underground samples as described in the ITR Mineral Resource Estimate and Preliminary Economic Assessment of Irumafimpa and Kora Gold Deposits, Kainantu Project, PNG dated March 2, 2017.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events, or developments that the Company believes, expects, or anticipates will or may occur are forward-looking information, including statements regarding the realization of the preliminary economic analysis for the Project, expectations of future cash flows, the proposed plant expansion, potential expansion of resources and the generation of further drilling results which may or may not occur. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the market price of the Company’s securities, metal prices, exchange rates, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes, failure of plant, equipment or processes to operate as anticipated, accidents, labour disputes, claims and limitations on insurance coverage and other risks of the mining industry, changes in national and local government regulation of mining operations, and regulations and other matters.. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Four photos accompanying this announcement are available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/410675ea-dff8-44cb-9d98-43c237cd05f0

http://www.globenewswire.com/NewsRoom/AttachmentNg/0e101f99-9f59-4ae2-a4ed-96363dfaba7f

http://www.globenewswire.com/NewsRoom/AttachmentNg/9ec968ea-e527-4486-8531-5576043af0bf

http://www.globenewswire.com/NewsRoom/AttachmentNg/07c87ad8-823d-404a-9bdd-d6353e812175