K92 Is Pleased To Provide A Production Update On The Kainantu Gold Mine For The March Quarter Of 2017

- Total production of 23,400 tonnes mined, primarily from development of the 1205 mRL, 1220 mRL and 1235 mRL, a production rate significantly above the 13,645 tonnes scheduled in the AMDAD Mine Plan

- The first stope production now mined from the remnant stopes

- The Process Plant treated just under 12,000 tonnes in March and has regularly achieved over 600 tonnes per day, which is above design throughput

- Grade control drilling and sampling for the initial mining area, comprising stopes and development from 1205 mRL to 1265 mRL levels and between 59450 North and 59700 North, defines 38% more tonnes and 13% more ozs than the AMDAD design

- Detailed design work incorporating all results from the grade control drilling and face samples has defined a total of 35,716 tonnes at a grade of 6.53 g/t Au (25,446 tonnes @ 6.20g/t Au Measured Resource and 10,260 tonnes @ 7.35 g/t Indicated Resource) as remaining to be mined from initial stopes and 1,175 tonnes at a grade of 7.52 g/t Au (Indicated Resource) to be mined from the 1250 mRL level (see Table 3).

- As at 31st March 2017, surface stockpiles, from mining of development material, contained a total of 9,000 tonnes at a grade of 4.54 g/t Au. This material was classified as a Measured Resource.

- Over 270 tonnes of concentrate trucked to the port of Lae during the quarter with shipments ongoing

MINING

The current mine plan is based upon the 3 Year Mine Plan prepared by Australian Mine Design and Development (“AMDAD”) which is detailed in the “Independent Technical Report, Mineral Resource Update and Preliminary Economic Assessment (“PEA”) of Irumafimpa and Kora Gold Deposits, Kainantu Project, Papua New Guinea” with an effective date of March 2, 2017 (the “Technical Report”). Formal approval to restart underground production was received from the Mineral Resources Authority (“MRA”) in late October 2016 following the successful rehabilitation and refurbishment of the underground mine, so the effective start date for the AMDAD Mine Plan has been taken as 1st November 2016.

The majority of mining production to date has come from development on the 1205 mRL, 1220 mRL and 1235 mRL production levels between 59450 North and 59700 North, with a small amount of approximately 1,000 tonnes recovered from remnant stopes left behind by the previous operators on the 1250 mRL level.

The AMDAD Mine Plan based on the current Irumafimpa Resource provided in Table 4 below, called for a total of 13,645 tonnes at a grade of 6.69 g/t of development material containing 2,935 ozs to be mined during the quarter, with no stope production due until month 7. This material would be part of the Inferred Resource. In comparison K92 has mined 23,400 tonnes containing 3,400 ozs, with approximately 1,000 tonnes coming from existing remnant stopes based on material processed or remaining in stockpiles. (See Table 1).

The major difference between the AMDAD Mine Plan and actual performance to date is that a significant tonnage of material outside of defined stoping areas was originally classified as waste within the AMDAD plan but was processed as lower grade material during the commissioning, rather than being waste.

As was disclosed in the Company’s news releases dated March 3, 2017 February 4, 2016, the Company’s decision regarding production at the Kaintantu Gold Mine was not based on a feasibility study demonstrating economic and technical viability and, as a result, there is increased uncertainty and multiple technical and economic risks that are associated with this decision. These risks include areas that are analyzed in detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods and environmental and community impacts. In addition, there are certain specific risks associated with the Kaintantu Gold Mine (as described in the Technical Report) including, but not limited to, inadequate water access and access to power. Project failure may adversely impact K92 and future profitability. As such, K92 cautions the reader that where projects are put into production without first establishing mineral reserves, as opposed to mineral resources, supported by a technical report and completing a feasibility study such projects have historically had a higher risk of economic or technical failure.

The preliminary economic assessment (the “PEA”) contained in the Technical Report is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. The Technical Report contains a full description of all underlying assumptions relating to the PEA. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

TABLE 1 AMDAD MINE PLAN VERSUS ACTUAL MINE PRODUCTION

| Underground Development | |||

|---|---|---|---|

| March Quarter | |||

| AMDAD1 | Actual2 | ||

| Waste | m | 368 | 169 |

| Mineralisation | m | 460 | 536 |

| t | 13,645 | 23,400 | |

| Au g/t | 6.69 | 4.52 | |

| Ozs | 2,935 | 3,401 | |

| Total Development | m | 828 | 705 |

Note:

- Mineralisation is Inferred Resource

- Mineralisation is Measured Resource

During the quarter the Company also completed the installation significant infrastructure underground, including two new 55 kW ventilation fans, a leaky feeder radio communication system and extensions to the 11 kV power supply to the upper workings of the mine.

GRADE CONTROL AND STOPE DESIGN

A total of 35 grade control holes (3,200 metres) were completed underground by two diamond drill rigs during the quarter. In addition, a comprehensive program of face sampling has been undertaken, in which almost every development face which is within the known deposit is sampled. This has resulted in almost 300 faces being sampled on the 1205 mRL, 1220 mRL and 1235 mRL levels generating over 1,300 samples. The results from grade control drilling and face sampling have been used to update the stope design model and provide an updated estimate of the tonnage and grade of the stopes it is planned to mine in the next six months.

A comparison of the tonnage and grade of the first stopes between between 1205 mRL and 1265 mRL levels and from 59450 North and 59700 North – an area approximately 250 metres long and 60 metres high at the extremity of the known deposit (“Initial Mining Area”) has been carried out between the original AMDAD design and the updated designs incorporating the grade control information is provided in the Tables 2 and 3 below. The comparison breaks down the total tonnage from the area into development tonnes and stope tonnes.

The AMDAD design defined a total of 44,073 tonnes at a grade of 6.83 g/t Au, containing 9,679 ozs in the Initial Mining Area. This tonnage comprised 33,539 tonnes at a grade of 6.71 g/t Au to be mined from stopes and a further 10,534 tonnes at a grade of 7.20 g/t Au mined from development of the 1205 mRL, 1220 mRL, 1235 mRL, and 1250 mRL levels. All of the material in this initial mining area forms part of the Inferred Resource outlined in Table 4.

The more detailed design carried out by K92 incorporating all of the results from the grade control drilling and face samples has defined a total of 35,716 tonnes at a grade of 6.53 g/t Au as remaining to be mined from stopes and 1,175 tonnes at a grade of 7.52 g/t Au to be mined from the 1250 mRL level. This being in addition to the 25,000 tonnes at a grade of 4.23 g/t that has already been mined during the development of the 1205 mRL, 1220 mRL and 1235 mRL levels over the last months, giving a total of 60,809 tonnes at a grade of 5.58 g/t Au, containing 10,914 ozs within the defined area. This material has been defined by extensive grade control drilling and face sampling of developments and is classified as Measured Resource up to the1250 mRL level and Indicated Resource between the 1250 mRL and 1265 mRL levels (see Table 3).

In summary:

- Total tonnes defined by K92 grade control drilling and sampling in the stopes are 6.5% above that defined by AMDAD, while total tonnes from the above specified area are 38% above those defined in the AMDAD model

- The stope grade defined by K92 at 6.53 g/t Au (Table 3) is 2.7% below the 6.71 g/t Au defined in the AMDAD design (Table 2)

- The total contained ozs defined by K92 in the stopes (Table 3) is 3.6% above those identified in the AMDAD design (Table 2), while total ozs from the above specified area are 13% above those identified in the AMDAD model.

TABLE 2 AMDAD DESIGN

| AMDAD Design | |||||

|---|---|---|---|---|---|

| Level | Classification | Volume | Tonnes | Grade | Ozs |

| m3 | t | g/t Au | |||

| 1205 – 1220 | Inferred | 3,876 | 11,240 | 5.83 | 2,107 |

| 1220 – 1235 | Inferred | 3,736 | 10,834 | 5.96 | 2,076 |

| 1235 – 1250 | Inferred | 2,603 | 7,549 | 7.48 | 1,815 |

| 1250 – 1265 | Inferred | 2,330 | 6,757 | 8.36 | 1,816 |

| Sub Total – Stopes | 12,374 | 35,360 | 7.05 | 8,015 | |

| Sub Total Development | Inferred | 10,534 | 7.20 | 2,438 | |

| TOTAL | Inferred | 45,894 | 7.08 | 10,453 | |

TABLE 3 K92 DESIGN AND ACTUAL

| K92 Grade Control Design | |||||

|---|---|---|---|---|---|

| Level | Classification | Volume | Tonnes | Grade | Ozs |

| m3 | t | g/t Au | |||

| 1205 – 1220 | Measured | 2,479 | 7,189 | 5.34 | 1,234 |

| 1220 – 1235 | Measured | 3,610 | 10,469 | 5.96 | 2,006 |

| 1235 – 1250 | Measured | 2,689 | 7,798 | 7.32 | 1,835 |

| 1250 – 1265 | Indicated | 3,538 | 10,260 | 7.35 | 2,425 |

| Sub Total Stopes | 12,316 | 35,716 | 6.53 | 7,500 | |

| Mined Dev to 31/3/2017 | Measured | 23,918 | 4.07 | 3,130 | |

| Planned Dev 1235/1250 | Indicated | 1,175 | 7.52 | 284 | |

| Sub Total Development | 25,093 | 4.23 | 3,414 | ||

| Total | Meas + Indicated | 12,316 | 60,809 | 5.58 | 10,914 |

The significantly higher tonnage of development material mined at lower grade than predicted from the AMDAD model is due primarily to the mining of lower grade material outside of the defined stope areas which was identified during face sampling. K92 mined and treated this material as part of the commissioning process for the process plant.

PROCESSING

The process plant throughput has ramped from just over 2,000 tonnes treated in January to almost 12,000 tonnes treated in March. Despite treating only development material assaying at just under 4 g/t Au, the plant produced saleable grade concentrate during the entire month of March, with an average grade of 111 g/t Au. The final concentrate produced has also averaged almost 6% copper, which is over twice that produced by the previous operators. Unlike the previous offtake agreements, the agreement which K92 incorporates payment for copper, and this level of copper increased the revenue for this first batch by approximately 4%. A total of 270 dry tonnes of concentrate was transported to the port of Lae during the month, while a number of additional containers were loaded with concentrate and ready for transport to the port at the end of the Quarter.

Recoveries have been steadily increasing as the plant has moved towards steady state operations and averaged 72% in March, despite the relatively low head grade. The plant demonstrated the ability to treat in excess of 600 tonnes per day, while achieving grinds of in excess of 70% minus 45 microns, with only a light ball charge in the mill. This confirms the view of the Company that the plant has significant excess capacity.

The newly installed and commissioned drum scrubber is now fully operational and has allowed the plant to treat extremely wet sticky mill feed from underground which would previously not have been able to be handled by the crushing circuit. The scrubber successfully removes all fines and clays, allowing them to bypass the crusher and report to the milling circuit, while the coarse fraction can be easily handled through the crushing circuit.

The new configuration with the drum scrubber also provides significant flexibility to the process plant, allowing the milling and flotation circuits to operate on feed from only the drum scrubber undersize, only the crushed material from the Fine Ore Bin or a combination of the two.

During the quarter the Company purchased, installed, and commissioned two 1,250 kW diesel generators to provide complete standby power for the process plant, offices, workshop, and camp. A third diesel generator located at the portal provides standby power for the underground mining operations.

TABLE 4 IRUMAFIMPA RESOURCE AND CATEGORY

| Deposit | Resource Category | Tonnes | Gold | Silver | Copper | Gold Equivalent | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mt | g/t | MOz | g/t | MOz | % | Mlb | g/t | MOz | ||

| Irumafimpa | Indicated | 0.56 | 12.8 | 0.23 | 9 | 0.16 | 0.28 | 37 | 13.4 | 0.24 |

| Inferred | 0.53 | 10.9 | 0.19 | 9 | 0.16 | 0.27 | 74 | 11.5 | 0.20 | |

EXPLORATION

KORA

The underground incline drive from the Irumafimpa Mine towards the Kora Deposit was commenced during the quarter. This 5m x 5m drive is designed to provide access to the Kora deposit, where K92 is targeting the commencement of production in First Half 2018, while also providing the Company with the ability to drill test thereafter between Irumafimpa and Kora from underground set ups. This area has not been previously tested due to topographical challenges associated with drilling from the surface and is considered highly prospective given the current interpretation of Irumafimpa and Kora being on the same vein structure.

OTHER

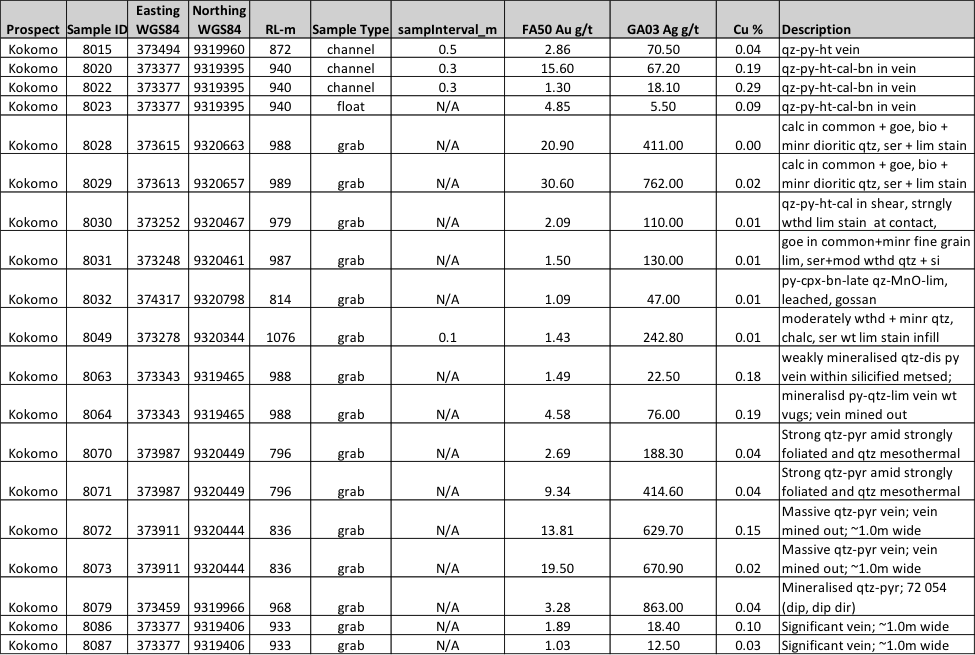

The Company completed the first phase of surface exploration work, including ridge and spur soil sampling, rock chip sampling and creek traversing for the Pomasi Area 1 within EL’s (Exploration Leases) 683 and 470 immediately to the north and west of the company’s ML (Mining Lease) 150.

The exploration team have identified numerous quartz veins, which are potentially extensions of the known mineralised vein systems (Irumafimpa/Kora, Judd & Karempa) encountered within ML 150. Selected results for this initial program are provided in Table 5.

TABLE 5 POMASI AREA 1 SELECTED RESULTS

JUNE QUARTER

Mining in the June Quarter will focus on development along the deposit on the 1250 mRL level between 59450 North and 59630 North, together with access to, and development along, the deposit on the 1205 mRl, 1220 mRL and 1235 mRL levels between 59700 North and 59950 North.

The mining production levels of 1,000 to 2,000 tonnes per month will be maintained in the coming quarter from remnant stopes from the 1250 mRL and 1280 mRL levels. This will be a combination of mining of broken material remaining from previous operations and blasting of stopes which had been established or commenced by the previous operators.

New stope mining is scheduled to commence in May with material from the 1235 mRL to 1250 mRL stopes between 59450 North and 59700 North. The commencement of new stope mining from the lower grade 1205 mRL and 1220 mRL levels is awaiting geotechnical input from independent consultants to finalise the design and extraction schedules as the ground conditions in this area is significantly different from that experienced in the rest of the deposit, requiring modifications to the current design.

Ian Stalker, K92 Chief Executive Officer and Director, states,

The March Quarter has shown solid progress and gives the Company confidence going forward. It is significant to note that that three of the four stoping areas have recorded significant increases in both tonnes and contained ozs in comparison to the AMDAD design and only one, the 1205 – 1220 stope area, which is at the extremity of the known Irumafimpa deposit. While this is only the first stoping area and some variability is to be expected within the mineral resource, it is nevertheless pleasing to see that in this case as we move into upper stopes we consistently see more tonnes and contained ozs in our grade control designs than from the AMDAD design, with the 1250 – 1265 stopes reporting a 50% increase in contained ozs.

ON BEHALF OF THE COMPANY,

Ian Stalker

Chief Executive Officer and Director

The TSX Venture Exchange has neither approved nor disapproved the contents of this press release.

K92 Manager Geology and Underground Exploration Andrew Kohler, P.Geo, a qualified person under the meaning of Canadian National Instrument 43-101, has reviewed and is responsible for the technical content of this news release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information, including statements regarding potential ongoing production which may or may not occur and the generation of further production assessment work at deposits, which may or may not occur. The Preliminary Economic Assessment (“PEA”) issued by K92 is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the market price of the Company’s securities, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes, failure of plant, equipment or processes to operate as anticipated, accidents, labour disputes, claims and limitations on insurance coverage and other risks of the mining industry, changes in national and local government regulation of mining operations, and regulations and other matters. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.