K92 Mining Announces Bulk Sample Preliminary Results at Judd Vein System and Commencement of Phase 1 Judd Drill Program

- First significant exploration undertaken on Judd by K92, with approximately 109 metres of 5.5m x 5.5m development completed on Judd #1 Vein, one of four known Judd veins. Based on grade control channel sampling, an estimated 6,200 tonnes at 5.5 g/t gold equivalent (“AuEq”) or 3.6 g/t gold, 1.11% copper and 19 g/t silver with an average thickness of 3.4 metres was extracted from Judd #1 Vein.

- Development drive reported solid geotechnical competency and multiple high-grade Judd #1 Vein faces from channel sampling, including:

• 2.2m thickness at 18.7 g/t AuEq or 17.4 g/t Au, 0.65% Cu and 26 g/t Ag;

• 3.5m thickness at 9.8 g/t AuEq or 3.7 g/t Au, 3.73% Cu and 42 g/t Ag;

• 3.7m thickness at 9.5 g/t AuEq or 7.4 g/t Au, 1.28% Cu and 17 g/t Ag, and;

• 4.2m thickness at 8.7 g/t AuEq or 6.0 g/t Au, 1.46% Cu and 37 g/t Ag. - Mineralization style from development drive is intrusive related, gold-copper-silver, and similar to Kora.

- Diamond drill rig mobilized to commence underground Phase 1 Judd Vein System drill program, targeting strike and vertical extensions.

VANCOUVER, British Columbia, Sept. 03, 2020 (GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92” or the “Company”) (TSX-V: KNT; OTCQX: KNTNF) is pleased to announce preliminary underground bulk sample results from the Judd Vein System at the Kainantu Gold Mine in Papua New Guinea. The Judd Vein System is located near-mine infrastructure, ~100-150m North-East from the producing Kora deposit and consists of four known veins, with the bulk sample from Judd #1 Vein. The Judd Vein System has seen very limited exploration, has four known veins and has a target strike length of approximately 2.5 km sub-parallel to Kora. Historical drilling results from previous owners include 3m at 278.2 g/t Au and 0.21% Cu, 9m at 8.32 g/t Au and 1.11% Cu (core length), and K92 intersected Judd in a surface drill hole targeting Kora, ~500m to the South of those historical holes 4.7m at 4.98 g/t Au, 0.02% Cu and 17 g/t Ag (5.22 g/t AuEq, 4.2m true thickness) – see September 9, 2019 press release K92 Mining Announces Latest High-Grade Drill Results from Kora. The results mark the first significant exploration activity undertaken on Judd by K92.

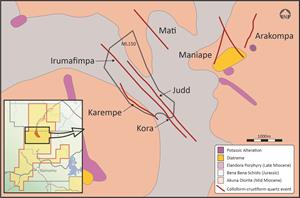

See Figure 1 for location map of Judd Vein target and other proximal interpreted vein targets.

The bulk sample was completed on the 1235 mRL level as multi-purpose, mine infrastructure development drive with oversized ventilation return airway dimensions of 5.5m x 5.5m. Approximately 109 metres of development was completed and from grade control channel sampling, an estimated 6,200 tonnes at 5.5 g/t gold equivalent or 3.6g/t gold, 1.11% copper and 19 g/t silver with an average thickness of 3.4 metres was extracted from Judd #1 Vein. Incorporating excess dilution from the oversized 5.5m x 5.5m return airway drive, an estimated 10,130 tonnes at 3.6 g/t AuEq or 2.40 g/t Au, 0.70% Cu and 12 g/t Ag was extracted.

A majority of the bulk sample has been stockpiled, with earlier mined material processed through the Kainantu processing plant. The remaining bulk sample and additional material mined will be processed separately through the Kainantu plant once the Stage 2 Process Plant Expansion commissioning is completed. Ground conditions are competent and are expected to be amenable to mining widths similar to the average Judd #1 Vein thickness and those currently mined at Kora, which is a minimum of 2 metres wide for long hole stoping and minimum 3 metres wide for cut and fill.

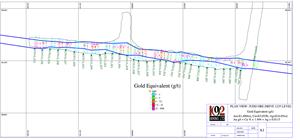

See Figure 2 for a plan view of the underground channel sampling and Judd #1 Vein interpretation.

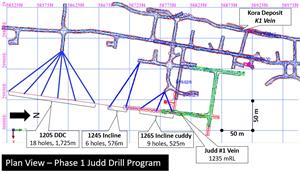

As a result of the promising results to date, an underground diamond drill rig has been mobilized for a Phase 1 Judd Vein system drilling program. The initial drill program planned is a 33-hole program, targeting strike extensions from the development drive of approximately 250 metres in addition to up-dip and down-dip step-out drilling. The bulk sample development drive will also be extended.

See Figure 3 for a plan view of the Phase 1 Judd Vein System drill program.

(Gold Equivalent (AuEq) is calculated using copper price of US$3.05/lb, silver price of US$16.05/oz and gold price of US$1,400/oz.)

John Lewins, K92 Chief Executive Officer and Director, stated, “We are certainly excited by these initial results from the bulk sampling of the Judd #1 Vein. The results mark the first significant exploration program on the Judd target by K92. With a potential strike length of ~2.5km, a known vertical extent of over 700 metres that remains open at depth, similar gold-copper-silver mineralization to Kora and encouraging grades, we are very encouraged about its potential. As a result, we have mobilized a drill rig to commence the Phase 1 Judd Exploration program and will continue to extend the development drive.

Exploration activities are also significantly increasing property wide. An additional drill rig has arrived on site this past week, increasing our total to eight, and we expect to have nine rigs on site by the end of the third quarter and ten by the end of the year. The additional drill rigs have meaningfully increased our rate of exploration and capacity to drill multiple targets concurrently. By the end of the year, we expect to have drills operating on Kora, Kora South, Judd, Karempe and Blue Lake. Approximately ~20% of the known vein field strike has been drill tested and Kora remains open at depth.”

Qualified Person

K92 mine geology manager and mine exploration manager, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver from the Kora deposit at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018 and is in a strong financial position.

The Company commenced an expansion of the mine based on an updated Preliminary Economic Assessment on the property which was published in January 2019 and updated in July 2020. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA at +1-604-687-7130.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events, or developments that the Company believes, expects or anticipates will or may occur are forward-looking information, including statements regarding the realization of the preliminary economic analysis for the Kainantu Project, expectations of future cash flows, the planned plant expansion, production results, cost of sales, sales of production, potential expansion of resources and the generation of further drilling results which may or may not occur. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the market price of the Company’s securities, metal prices, exchange rates, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes, failure of plant, equipment or processes to operate as anticipated, accidents, labour disputes, claims and limitations on insurance coverage and other risks of the mining industry, changes in national and local government regulation of mining operations in PNG, mitigation of the Covid-19 pandemic, continuation of the lifted state of emergency, and regulations and other matters. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1 – Location of Near-Mine Vein Targets is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/11f2dfdc-e3e0-4a07-884b-7de8f8baa695

Figure 2 – Judd #1 Vein Plan View Channel Samples is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/452ff5f5-8619-49c7-a700-e41578df8bfc

Figure 3 – Plan View of Phase 1 Judd Exploration Drilling Plan is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3c3c835c-fb7f-4d2b-b38f-c7127296a6b1